Oth Limits 2024. Best roth ira providers of june 2024. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Starting in 2024, rmds will no longer be required from roth accounts in employer retirement plans.

The Annual Roth Ira Contribution Limit In 2023 Is $6,500 For Adults Younger Than 50 And $7,500 For Adults 50 And Older.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older.

If You're Age 50 And Older, You.

For 2024, you can contribute to a roth ira if your income is $161,000 or less as a single filer or $240,000 or less if you’re married filing jointly.

The 2024 Annual Ira Contribution Limit Is $7,000 For Individuals Under 50, Or $8,000 For 50 Or Older.

Images References :

Source: frankiewlory.pages.dev

Source: frankiewlory.pages.dev

Deadline For Roth Contribution 2024 Shea Yettie, As this was an election year, the government had presented an interim budget in february. Best roth ira providers of june 2024.

Source: frederiquewnelia.pages.dev

Source: frederiquewnelia.pages.dev

401k Roth Contribution Limit 2024 Bianka Papagena, The president will administer the oath of office and secrecy to prime minister narendra modi and other members of the union council. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older.

Source: ardisjqcarissa.pages.dev

Source: ardisjqcarissa.pages.dev

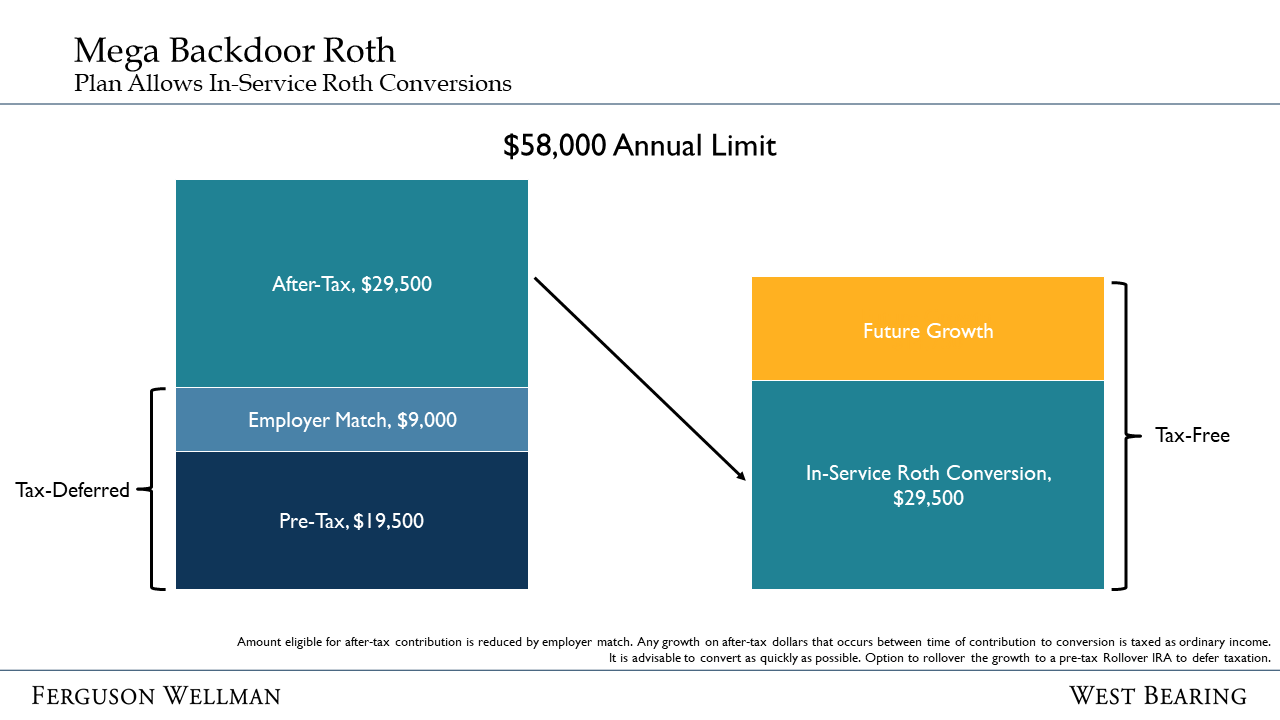

Mega Backdoor Roth Limit 2024 Cris Michal, The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50. The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023.

Source: lexisqrubina.pages.dev

Source: lexisqrubina.pages.dev

Esa Limits 2024 Abbe Lindsy, Starting in 2024, rmds will no longer be required from roth accounts in employer retirement plans. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Source: maggiewmelba.pages.dev

Source: maggiewmelba.pages.dev

Roth 401k 2024 Limits Davine Merlina, And to account for a rise in the cost of living, contribution limits usually change annually. The president will administer the oath of office and secrecy to prime minister narendra modi and other members of the union council.

Source: maribethwmaire.pages.dev

Source: maribethwmaire.pages.dev

Roth Ira Limits 2024 Limits For Over Perla Brandais, This figure is up from the 2023 limit of $6,500. For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

Roth Limits 2024 Ardra Brittan, Remains one of the largest such. Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older).

Source: joseyqmalena.pages.dev

Source: joseyqmalena.pages.dev

What Is The Roth Ira Limit For 2024 Claire Joann, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older. Less than $146,000 if you are a single filer.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know RGWM Insights, If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2024.

Source: devondrawlexis.pages.dev

Source: devondrawlexis.pages.dev

What Is The Max Roth Contribution For 2024 Esma Odille, A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Whether or not you can make the maximum roth ira contribution (for 2024 $7,000 annually, or $8,000 if you're age.

You Cannot Deduct Contributions To A Roth Ira.

The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

You're Allowed To Invest $7,000 (Or $8,000 If You're 50 Or Older) In 2024.

Teaching your child the power of saving and investing will set them on the path toward a million.