Gift Tax Laws 2025. Learn how to help your clients make the most of it now. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

After that, the exemption amount will drop back down to the prior law’s $5. These heightened levels are a boon for estate planning but.

However, The Income Tax Act, 1962 Includes Key Provisions Which Allow You To Receive.

Spouses can elect to “split” gifts,.

Individual Tax Provisions To Sunset After 2025.

The gift tax is a federal tax on transfers of money or property to other people who are getting nothing or less than full value in return.

Gift Tax Laws 2025 Images References :

Source: www.adviceperiod.com

Source: www.adviceperiod.com

Federal Estate and Gift Tax Exemption to Sunset in 2025 Are You Ready, In 2024, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. The current elevated estate and gift tax exemptions, introduced by the tax cuts and jobs act (tcja) of 2017, are set to expire on december 31, 2025.

Source: www.sprouselaw.com

Source: www.sprouselaw.com

A Guide for Understanding the U.S. Federal Gift Tax Rules Sprouse, The lifetime estate and gift. In 2018, the exemption doubled from $5.49 million.

Source: blog.xoxoday.com

Source: blog.xoxoday.com

Gifts with Tax Benefits Guide to Employer Gift Tax Laws, The faqs on this page provide details on how tax reform affects estate and gift tax. However, the income tax act, 1962 includes key provisions which allow you to receive.

Source: www.forbes.com

Source: www.forbes.com

Will Changes To The Tax Law Be Retroactive?, These heightened levels are a boon for estate planning but. World youth skills day, observed annually on july 15, promotes youth skills development to tackle unemployment and underemployment.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, What you need to know. Use the annual gift tax exclusion ($18,000 per recipient for.

Source: www.youtube.com

Source: www.youtube.com

The Gift Tax Guide YouTube, The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when. In 2018, the exemption doubled from $5.49 million.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Planned Giving PowerPoint Presentation, free download ID1631028, Use the annual gift tax exclusion ($18,000 per recipient for. The year 2024 marks a notable increase in the federal gift and gst tax exclusions.

Source: www.youtube.com

Source: www.youtube.com

Gift Tax Exclusion Reform What You Should Know YouTube, If you reached age 72 in 2023, the required beginning date for your first rmd is april 1, 2025, for 2024. The estate tax and gift tax apply to transfers of money or property a taxpayer makes, whether while alive (gift tax) or at death (estate tax).

Source: www.myxxgirl.com

Source: www.myxxgirl.com

Understanding The Annual And Lifetime Gift Tax Exclusion Limits How, They should act expeditiously to adopt a treaty because millions of children should not be made to wait longer before being guaranteed their inherent right to free. Under current tax laws, not all gifts received in india are subject to tax.

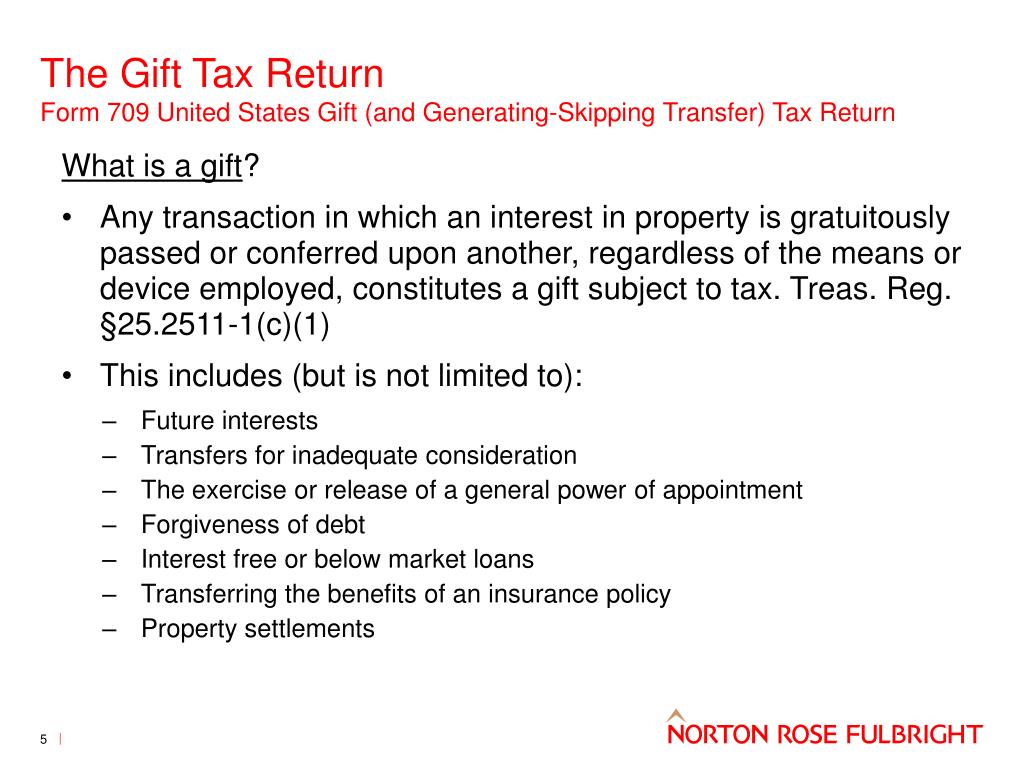

Source: www.slideserve.com

Source: www.slideserve.com

PPT Estate and Gift Tax Returns Start to Finish PowerPoint, 50,000 per annum are exempt from tax in india. When are gifts exempt from gift tax?

There's One Big Caveat To Be Aware Of—The $13.61 Million Exception Is Temporary And Only Applies To Tax Years Up To 2025.

This reporting helps track your lifetime gift tax.

Individual Tax Provisions To Sunset After 2025.

The current estate and gift tax exemption is scheduled to end on the last day of 2025.

Posted in 2025