401a Max Contribution 2025. If you're age 50 or. If you contribute, say, $23,000 toward your 401 (k) in 2024 and your employer adds $5,000, you’re still within the irs limits.

The higher you go up on the income scale, the higher the contribution rate, but the average contribution rates for all workers top out at 9.2%, and that’s for those. There are actually multiple limits, including an individual.

This Amount Is Up Modestly From 2023, When The Individual 401.

The higher you go up on the income scale, the higher the contribution rate, but the average contribution rates for all workers top out at 9.2%, and that's for those.

For 2024, The 401 (K) Contribution Limit For Employees Is $23,000, Or $30,500 If You Are Age 50 Or Older.

Some employees’ compensation will exceed the annual compensation limit this year.

401a Max Contribution 2025 Images References :

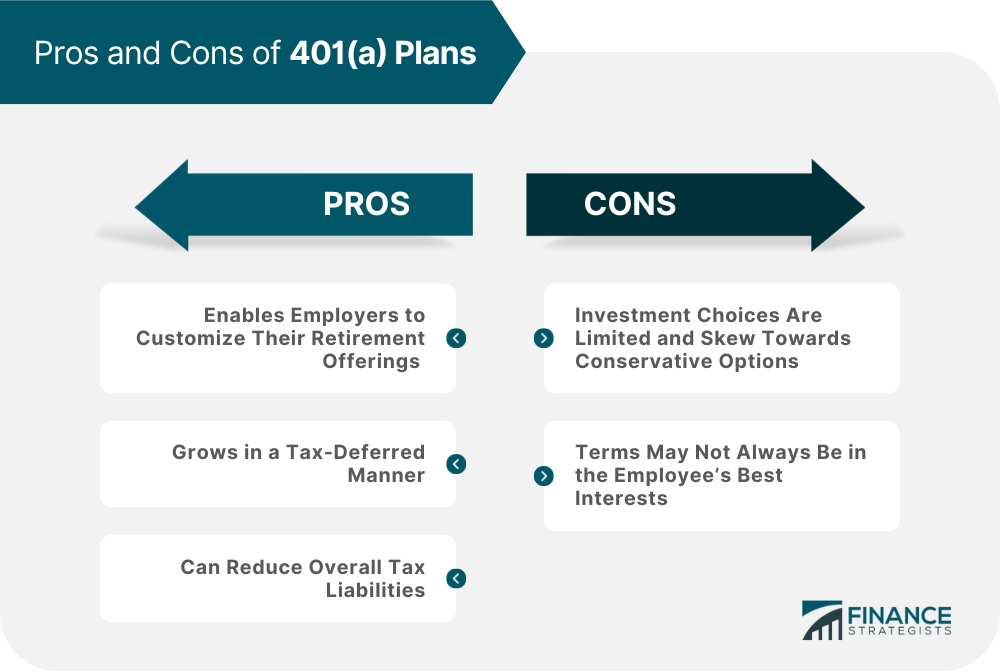

Source: www.financestrategists.com

Source: www.financestrategists.com

401(a) Plan Definition, How It Works, and Pros & Cons, The 401 (k) contribution limit is $23,000 in 2024. The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2024 to $71,000 in 2025.

Source: cigica.com

Source: cigica.com

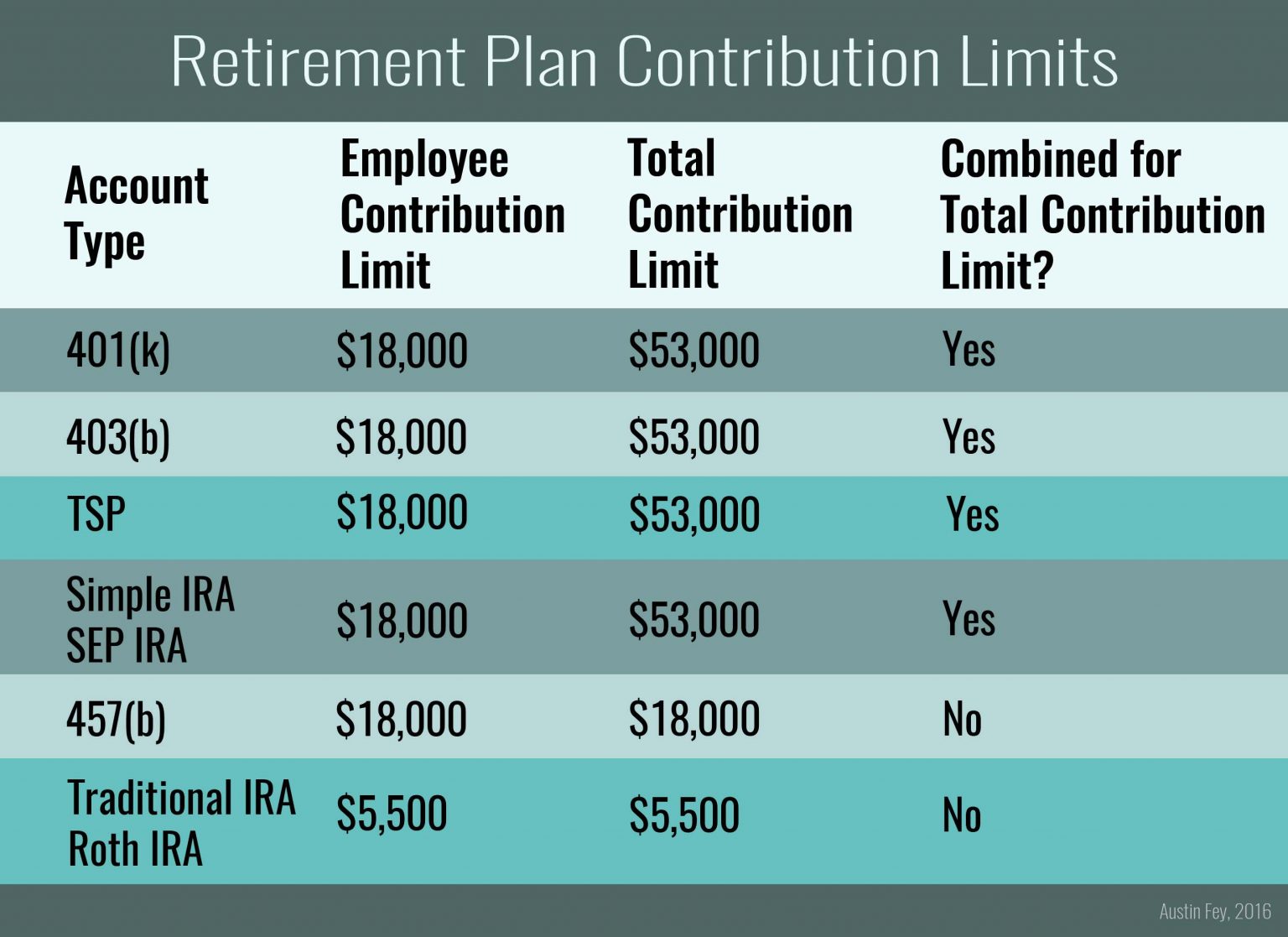

What’s the Maximum 401k Contribution Limit in 2022? (2023), There are also income requirements to contribute to a roth ira. The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2024 to $71,000 in 2025.

Source: brierqverina.pages.dev

Source: brierqverina.pages.dev

2024 Max Roth Berna Cecilia, The irs has announced the 2024 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and 457(b) plans, as well as income limits. Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs.

Source: www.internetvibes.net

Source: www.internetvibes.net

Choosing The Best Small Business Retirement Plan For Your Business, Max out your retirement account. The 401(k) contribution limit is $23,000 in 2024.

Source: donnyqcortney.pages.dev

Source: donnyqcortney.pages.dev

401k Max Contribution 2024 Employer Prudy Tomasina, Some employees’ compensation will exceed the annual compensation limit this year. The higher you go up on the income scale, the higher the contribution rate, but the average contribution rates for all workers top out at 9.2%, and that's for those.

Source: isabellewaddy.pages.dev

Source: isabellewaddy.pages.dev

2024 Max Employee 401k Contribution Cari Marsha, The 401 (k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions. This amount is up modestly from 2023, when the individual 401.

Source: mariyawblanch.pages.dev

Source: mariyawblanch.pages.dev

401k 2024 Max Contribution Limit Irs Sybil Euphemia, The higher you go up on the income scale, the higher the contribution rate, but the average contribution rates for all workers top out at 9.2%, and that's for those. Max out your retirement account.

Source: donnyqcortney.pages.dev

Source: donnyqcortney.pages.dev

401k Max Contribution 2024 Employer Prudy Tomasina, The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2024 to $71,000 in 2025. Should we stop their salary deferrals when their compensation reaches the.

Source: sherbsarine.pages.dev

Source: sherbsarine.pages.dev

What Is The Max Contribution For 401k In 2024 Kala Teressa, Every year, the irs sets the maximum 401 (k) contribution limits based on inflation (measured by cpi). Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2024 Meld Financial, For the 2024 tax year, married individuals filing jointly with a modified adjusted gross income. If you contribute, say, $23,000 toward your 401 (k) in 2024 and your employer adds $5,000, you’re still within the irs limits.

The Overall 401 (K) Limits For.

If you're age 50 or.

This Amount Is Up Modestly From 2023, When The Individual 401.

Those who are age 60, 61, 62, or 63 will soon be able to set aside.

Category: 2025